- Real Estate Navigator

- Posts

- 2026 U.S. Housing Market Forecast

2026 U.S. Housing Market Forecast

What buyers and sellers should know after a bumpy 2025

2026 Housing Forecast

1. 2025 Market Recap

How we got here matters.

2025 was a year of cautious movement, not chaos. The housing market did not crash, but it did not fully heal either.

Here’s the quick snapshot:

Affordability stayed tight: Home prices did not meaningfully reset, while incomes struggled to keep pace. Monthly payments remained the biggest hurdle for buyers.

Mortgage rates stayed elevated: Rates hovered above 6% most of the year, keeping many homeowners locked into their existing loans.

Inventory improved slightly: More listings came online, but supply still sat well below long-term norms.

Activity picked up, slowly: Buyers and sellers re-entered the market selectively, often driven by life events rather than timing the market.

Think of 2025 as a holding pattern. The market moved forward, just with the parking brake half on. Analysts at Investopedia widely described the year as constrained by affordability rather than lack of demand.

2. What Experts Are Forecasting for 2026

More motion, fewer stalemates.

Inventory and Market Balance

Most forecasts point to gradual improvement, not a flood.

Analysts cited by HousingWire expect inventory to continue rising as more sellers accept that 3% mortgages are not coming back anytime soon.

The goal for 2026 is not a buyer’s market, but a less lopsided one.

Home Sales and Price Growth

This is where forecasts diverge.

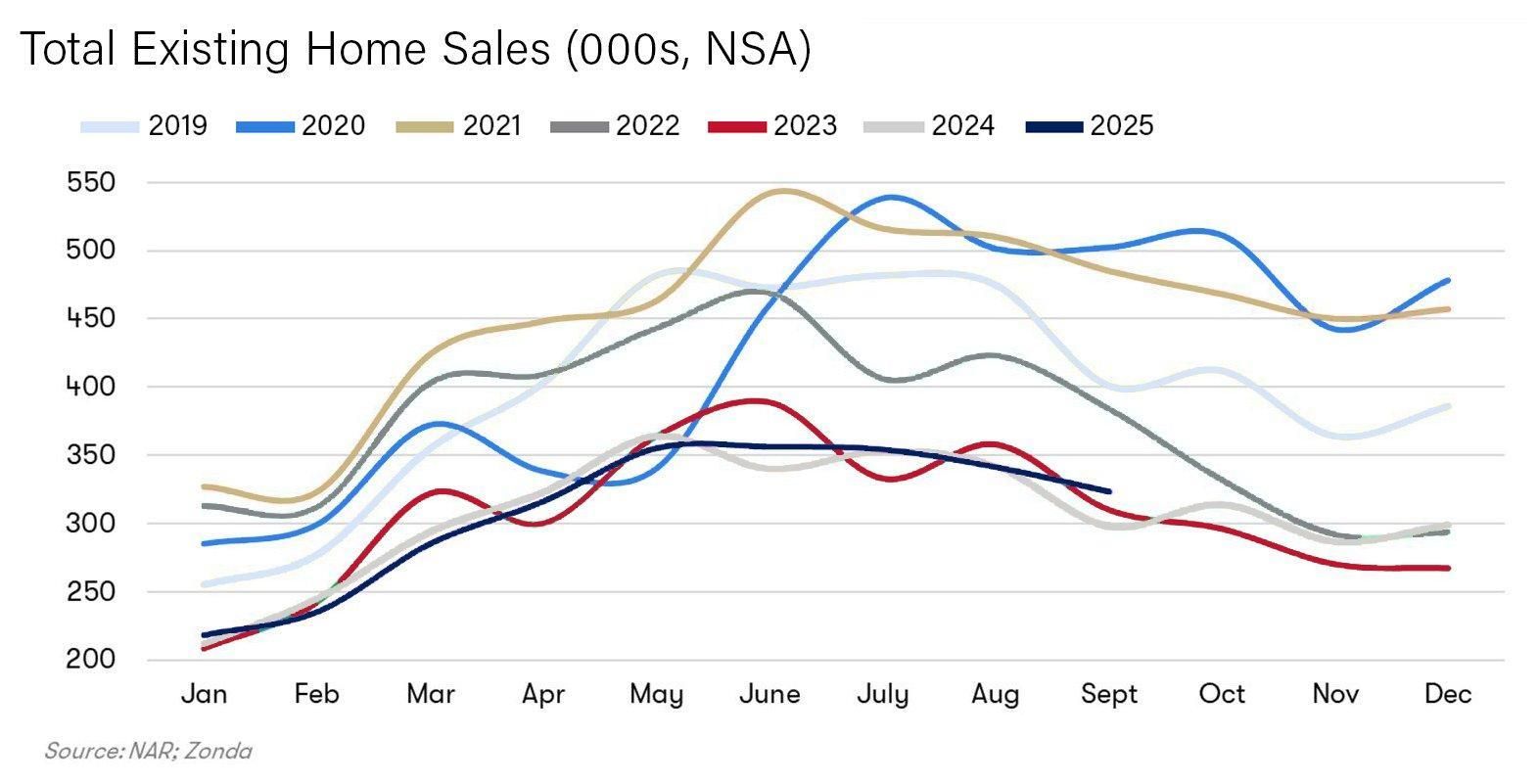

The National Association of Realtors projects existing home sales could rise by as much as ~14%, driven by slightly lower rates and better affordability math.

Other analysts expect a more restrained ~1.7% to 7–8% sales increase, reflecting ongoing affordability pressure.

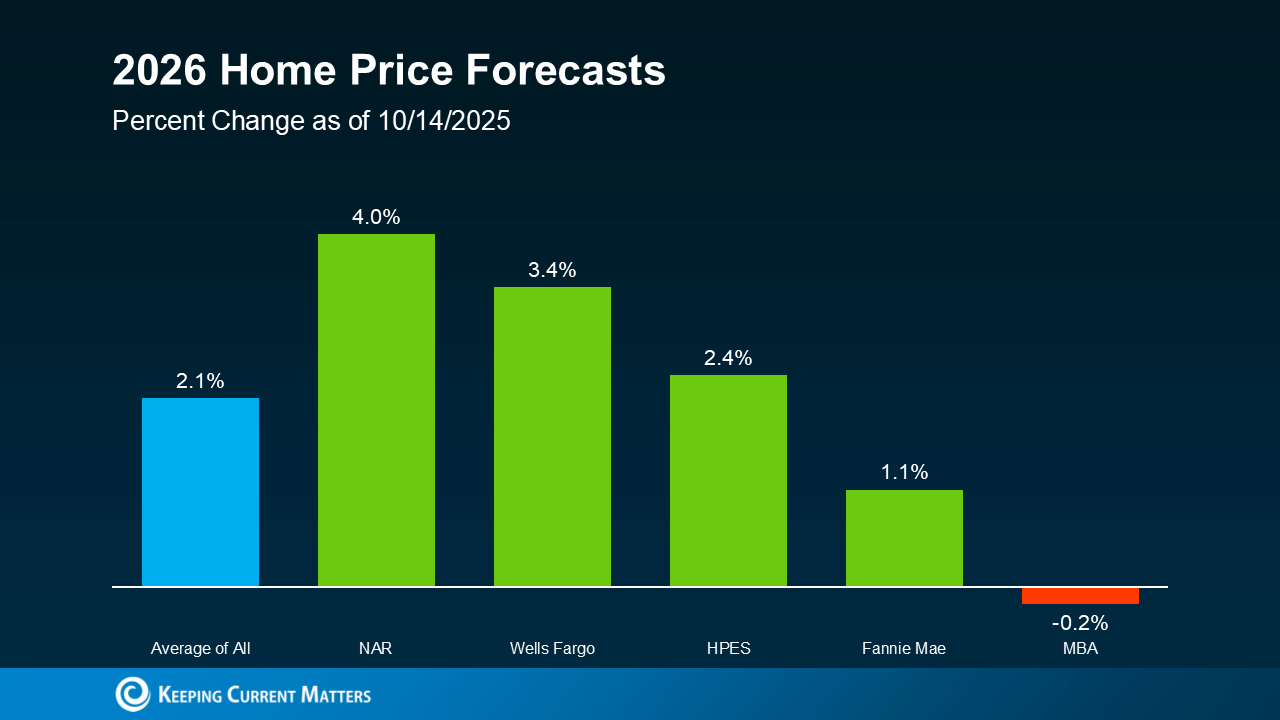

Home prices: Most forecasts agree price growth should cool and track closer to inflation rather than surge ahead of it.

In plain English: fewer bidding wars, fewer panic offers, and more room to negotiate.

Mortgage Rates

Rates are the hinge point.

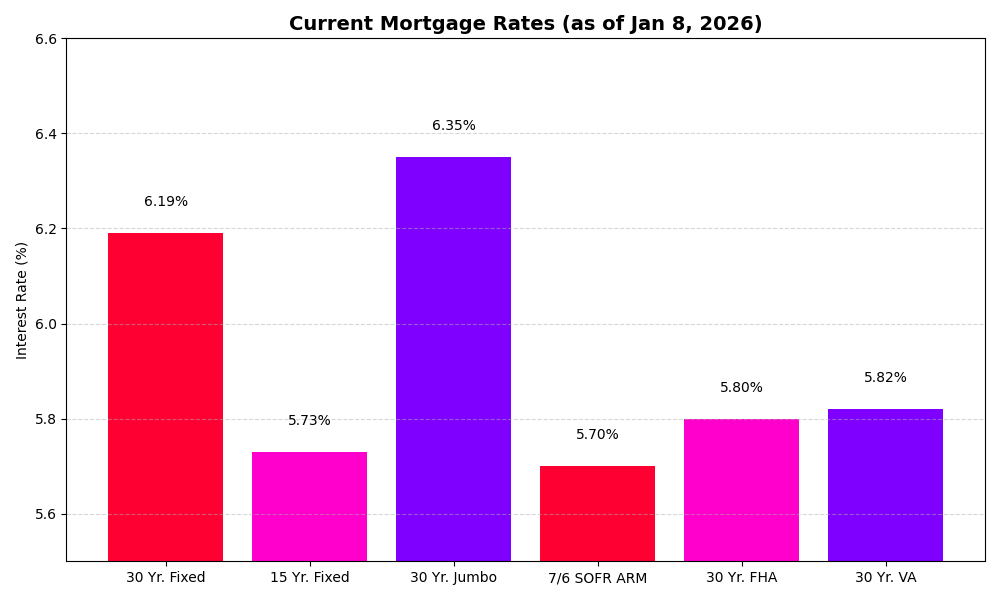

Forecasts from Redfin suggest mortgage rates may settle in the low-6% range for much of 2026, slightly better than 2025 but not a return to ultra-cheap money.

Lower rates help, but they do not magically fix affordability. They just loosen the jar lid.

3. What Could Sway the 2026 Forecast

This is where certainty ends.

Key variables to watch:

Interest rate paths: Faster than expected rate cuts could unleash pent-up demand. Sticky inflation could do the opposite.

Economic conditions: Job growth and wage gains directly affect buyer confidence and purchasing power.

Inventory dynamics: If listings lag demand, prices could stay stubbornly high even with more sales.

Regional differences: National averages hide local realities. Some metros will outperform, others will stall.

External risks: Policy shifts, inflation flare ups, or economic shocks can quickly reroute momentum.

This is not a crystal ball market. It is a probability market.

4. What This Means For Buyers and Sellers

For Buyers

More choices: Growing inventory means fewer take it or leave it scenarios.

Slightly better affordability: Lower rates plus stable prices help the monthly math.

Negotiation returns: Credits, repairs, and pricing conversations are back on the table in many markets.

Think of 2026 as less of a sprint and more of a controlled jog.

For Sellers

More buyers in motion: Rising sales activity means demand is not disappearing.

Pricing discipline matters: Overpricing in a balanced market leads to longer days on market.

Local data is everything: National optimism does not override neighborhood realities.

Good marketing and realistic pricing will separate winners from stale listings.

Bottom Line

The 2026 real estate market forecast points to more balance, modest growth, and fewer extremes.

2025 was constrained by affordability and elevated rates.

2026 may bring lower mortgage rates, rising inventory, and increased sales activity.

Prices are expected to grow slowly and sustainably, not explosively.

Outcomes will vary by region, timing, and personal situation.

This is not a market to wait for perfection. It is a market to plan smart, run the numbers, and move when the deal makes sense.

That’s the play.