- Real Estate Navigator

- Posts

- Closing Costs Explained: Who Pays What (and How Much)

Closing Costs Explained: Who Pays What (and How Much)

The Final Hurdle (and How to Clear It Without Face-Planting)

If buying or selling a home feels like a marathon, closing costs are the finish line fee. They’re the bundle of expenses that sneak in right before you get the keys or the check. Let’s break down what’s included, who pays what, and how to prepare so you’re not blindsided at the closing table.

What Are Closing Costs?

Closing costs are the out-of-pocket fees tied to finalizing a home sale. Think of them as the “cost of doing business” to transfer property legally and financially. They usually run 2–5% of the purchase price for buyers and can be 5–10% of the sale price for sellers (largely because of agent commissions).

For Buyers: Typical Costs

Buyers take on the lion’s share of fees tied to financing. Common charges include:

Loan origination fee: About 0.5–1% of the loan amount.

Appraisal fee: $400–$700 to confirm the home’s value.

Credit report fee: Around $30–$50.

Title search and insurance: $500–$1,500 to ensure no one else has a claim on the home.

Recording fees: $100–$250 to officially put your name on the deed.

Prepaid taxes and insurance: First months of property tax and homeowners insurance, usually a few thousand dollars.

👉 Example: On a $300,000 home with a conventional loan, a buyer might owe around $7,500–$10,000 in closing costs.

For Sellers: Typical Costs

Sellers’ costs are more about paying off obligations and passing a clean title. Expect:

Agent commissions: 5–6% of the sale price (biggest line item).

Owner’s title insurance policy: $500–$1,000 in many states.

Transfer taxes and recording fees: $1,000–$2,000, depending on location.

Attorney fees: Required in some states, $800–$1,500.

Outstanding liens or HOA dues: Varies by property.

👉 Example: Selling that same $300,000 home might cost the seller $18,000–$20,000, mostly in commissions.

Who Pays What (and What’s Negotiable)

Buyers usually cover: Loan-related fees, appraisals, inspections, credit reports, prepaid taxes/insurance.

Sellers usually cover: Commissions, title insurance, transfer taxes.

Negotiable items: Closing costs credits, transfer taxes, and even title fees can sometimes be split or shifted. In slower markets, sellers often agree to cover part of a buyer’s closing costs to sweeten the deal.

Tip: Always ask. The worst they can say is no.

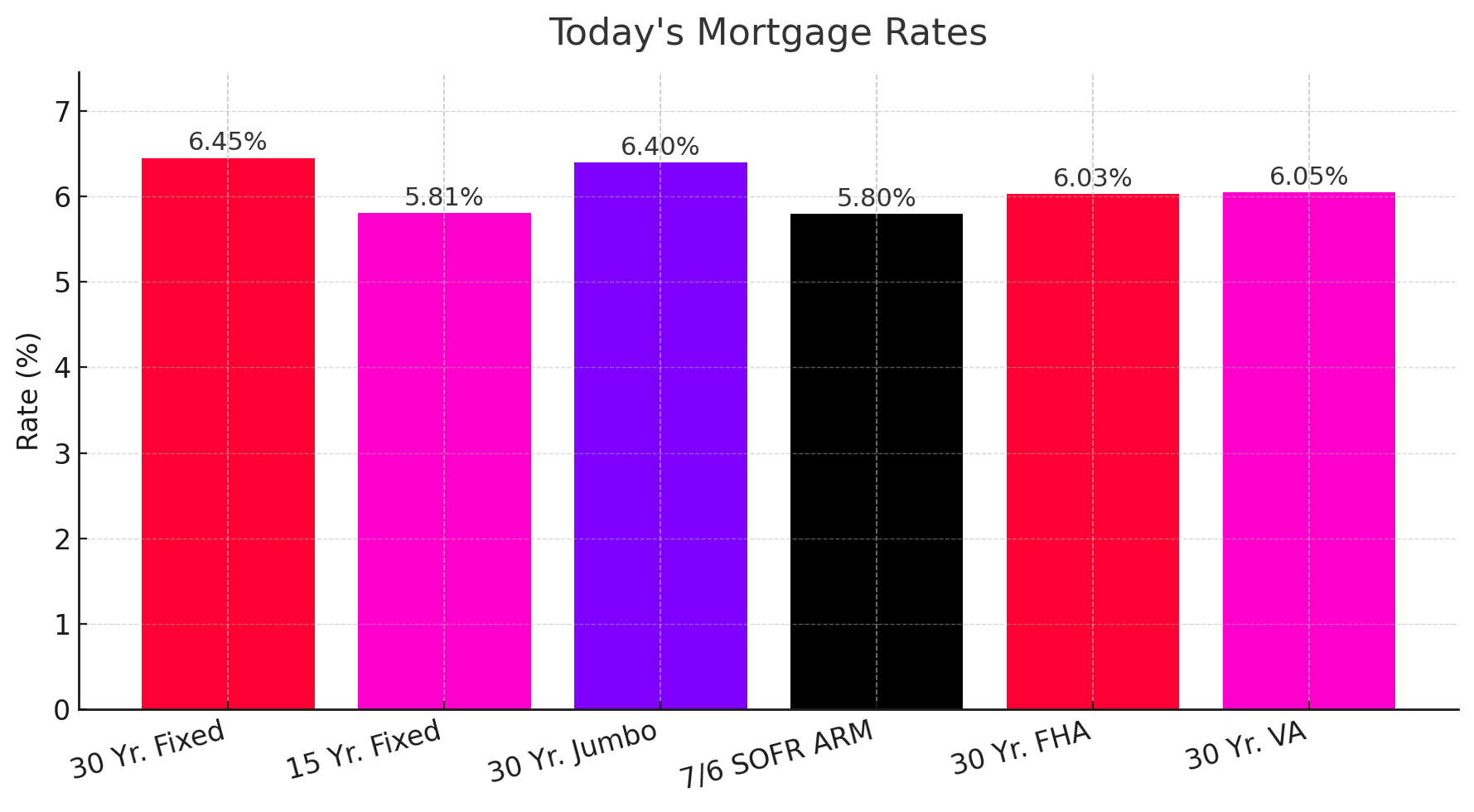

How Loan Type Changes the Bill

Closing costs aren’t one-size-fits-all. They vary by loan program:

Cash deals: Cheapest route. No lender = no loan origination or appraisal fee. Expect maybe $2,000–$4,000 total.

Conventional loans: Standard fees, 2–5% of the purchase price.

FHA loans: Extra charges like upfront mortgage insurance (1.75% of the loan). This can be rolled into the loan but still adds to the tally.

VA loans: No down payment, but you’ll see a one-time VA funding fee (unless exempt), ranging from 1.25–2.3% of the loan. Good news: sellers can cover this.

How Costs Vary by Location

High-tax states (like New York or New Jersey): Transfer taxes alone can run into thousands.

Low-tax states (like Texas or Florida): Lower closing costs but higher ongoing property taxes.

Attorney-required states: Add another $1,000+ to the bill.

Rules may vary, so always confirm with a local pro.

Tips to Prepare for Closing Costs

Get a Loan Estimate early: Your lender must provide this within 3 days of application.

Ask about lender credits: Some lenders will cover part of your costs in exchange for a slightly higher interest rate.

Budget 2–5% extra: Better to over-prepare than scramble at the last second.

Negotiate: Especially in a buyer’s market, sellers may cover thousands in costs just to seal the deal.

Bottom Line

Closing costs aren’t the fun part of buying or selling, but they’re the last checkpoint before the finish line. Buyers should expect 2–5% of the purchase price, sellers should brace for commissions plus extras, and both sides should know some fees are negotiable. The smartest move is to plan early, ask questions, and budget more than you think you’ll need. Your future keys or check depend on it.

Until next week!