- Real Estate Navigator

- Posts

- From 0% to 20%: Decoding Down Payments

From 0% to 20%: Decoding Down Payments

More than a number: The hidden impact of down payments.

Buying a home is rarely about just the price tag. One of the biggest factors in any deal is the down payment. The size of that upfront chunk of money can shape monthly payments, determine loan type, and even influence how sellers view an offer. Let’s break it down.

Different Loans, Different Rules

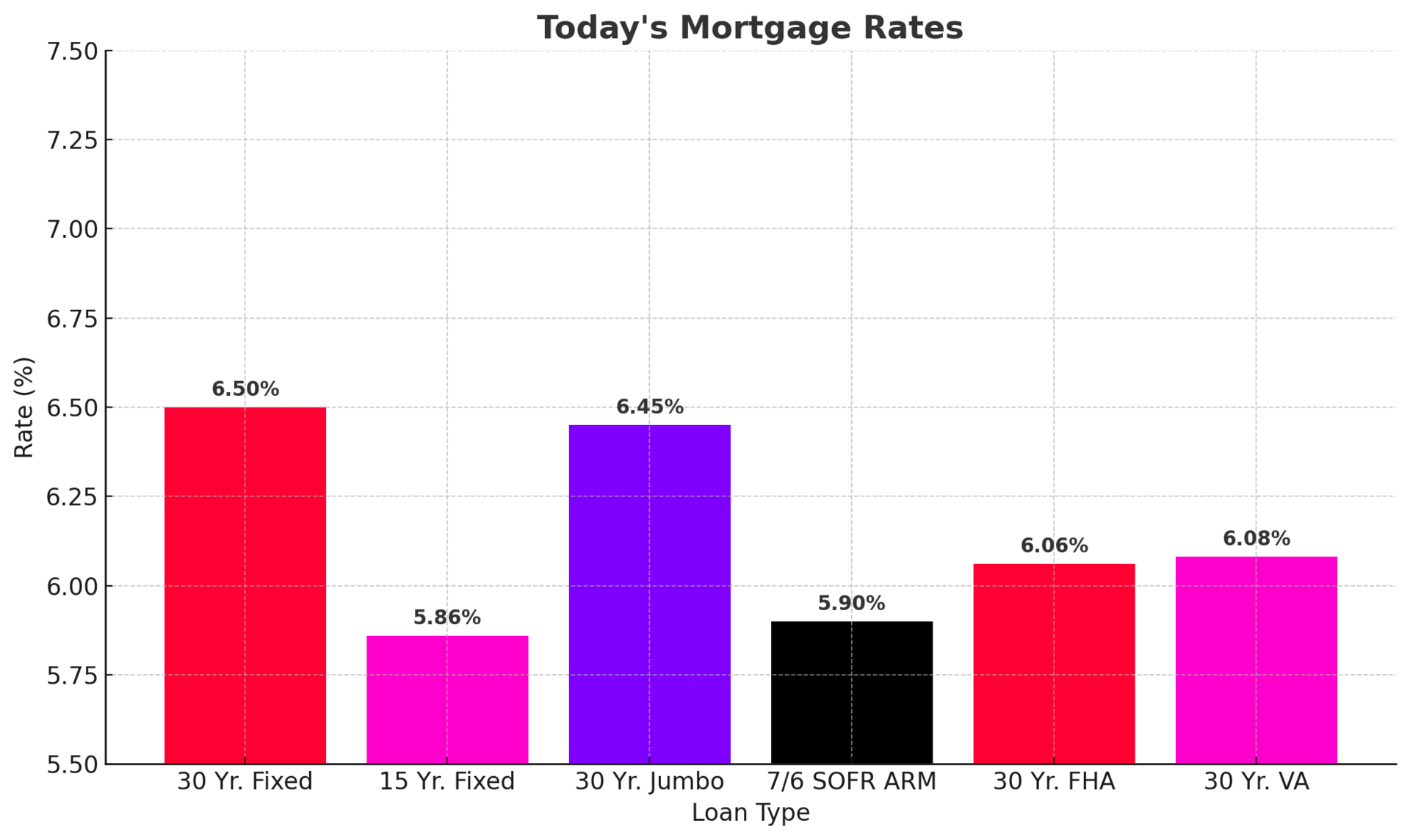

Conventional Loans: As little as 3% down with strong credit. Anything under 20% typically requires private mortgage insurance (PMI).

FHA Loans: 3.5% down with a credit score of 580+. If your score is between 500–579, plan on 10% down.

VA Loans: 0% down for eligible veterans and active-duty members. No mortgage insurance, but a one-time funding fee applies.

USDA Loans: 0% down for qualifying buyers in eligible rural areas. Location and income limits apply.

Jumbo Loans: Typically 10%–20%, but some lenders allow 5% with excellent credit and financial reserves.

What Down Payment Size Means for Buyers

Smaller Down Payment:

Easier entry into the market

Higher monthly payments

Mortgage insurance adds ongoing cost

Larger Down Payment:

Lower monthly payments

More equity from day one

Stronger position with lenders and sellers

What Down Payment Size Means for Sellers

High Down Payment:

Signals financial strength

Less chance of financing falling apart

Fewer appraisal worries

Low or No Down Payment:

May raise questions about financing stability

FHA/VA/USDA loans can trigger stricter appraisal standards

Still legitimate and common—just seen differently in competitive markets

Myths vs Reality

Myth: You always need 20% down.

Reality: Minimums range from 0% to 3.5%, depending on the loan.Myth: Down payment and closing costs are the same thing.

Reality: They’re separate. Closing costs usually run 2–5% of the purchase price.Myth: A low down payment means the buyer isn’t serious.

Reality: Many buyers qualify for strong loans with low or no money down.

Reading the Fine Print

Down payments are just one piece of the puzzle. Loan type, credit score, and reserves all matter. USDA loans only apply in certain areas, FHA comes with mandatory mortgage insurance, and jumbo loans require strict underwriting. Look beyond the percentage to understand the full picture.

Seller Strategy Tip

Do not judge an offer by the down payment alone. A 20% conventional buyer looks strong, but a VA or FHA buyer can be just as solid if the lender approval is solid. Ask for pre-approval letters, proof of funds for the down payment, and a lender contact. The best offer is the one most likely to close.

The Bottom Line

For buyers: your down payment affects everything from your monthly payment to how sellers view your offer. For sellers: do not write off low down payment offers—they can be just as strong as the “big” ones.

If you have any part of the process you would like to see in a future edition shoot us an email and we’ll look to break it down for you. Until next week!